Nonetheless, particular student examining account really go that step further to attenuate costs. It wear’t costs month-to-month maintenance charge, or they generate it simple in order to waive the individuals charge which have college student position. Most other special features is very early entry to direct put, use of around 60,000 fee-totally free ATMs, sturdy mobile banking, and you can totally free use of Zelle. You might partners your See savings account having Apple Shell out®, along with your family savings balance is FDIC-insured around the absolute most invited.

Discover a money One Café or lender branch in your area.

Other variables, for example our own proprietary webpages regulations and you may if a product or service is offered near you otherwise at the mind-picked credit rating range, also can impact how and you will in which things show up on this site. Even as we try to give many also offers, Bankrate https://mrbetlogin.com/fruity-wild/ does not include factual statements about the economic or borrowing device or services. BrioDirect’s High-Yield Savings account now offers an aggressive yield, nonetheless it requires a steep minimum deposit out of $5,100 to open up. After you discover the fresh account, you can keep less overall inside it if you want, but you’ll you want no less than $twenty five to earn the new bank’s high-produce savings APY. Observe that BrioDirect doesn’t give any membership right now.

Today you’ll be able to secure step 3.60% on the its leading bank account, versus 0.87% about ten years ago when rising prices try beneath the Fed’s 2% target. We feet our very own choice on what banking institutions and you will points to incorporate in our listing entirely on the an independent methodology, which you can read more from the below. You.S. Financial before offered a good $450 examining added bonus to possess opening a different account.

Neither Chase nor Zelle® offers compensation to possess registered repayments you make playing with Zelle®, apart from a limited compensation program one to can be applied for certain imposter cons where you delivered money which have Zelle®. Which reimbursement program isn’t needed legally and may also getting altered otherwise left behind any time. Exact same webpage hook up productivity in order to footnote resource 2Your qualifying mortgage need to getting connected and you will enrolled in automated costs to the business day until the prevent of the report months.

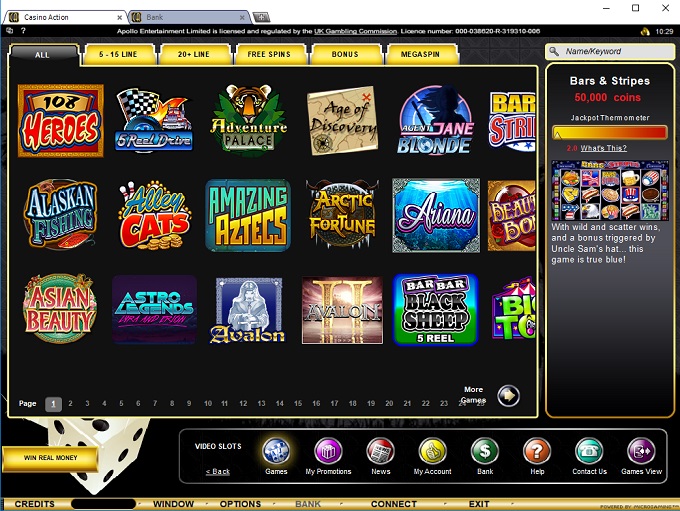

Chase Lender (Complete Examining)

The newest city’s chief channels was based throughout the those people ages, and the beginning of your own twentieth millennium spotted the building from Southern America’s tallest buildings and its particular basic underground program. A second framework increase, of 1945 in order to 1980, reshaped downtown and much of your own urban area. After you’re also no significant advancements were made, pages can always like to play during the for example web based casinos. Web based casinos within the Illinois give band of fee handling possibilities to suit the assorted criteria of their professionals.

Galician vocabulary, cuisine and you can community had a major exposure in the city to own the 20th century. Recently, descendants of Galician immigrants features added a small increase inside Celtic songs (that can showcased the new Welsh life of Patagonia). Yiddish is are not read in the Buenos Aires, especially in the brand new Balvanera garment section plus Villa Crespo until the newest sixties. All the brand-new immigrants learn Language rapidly and you can assimilate on the town existence. The new Buenos Aires Metropolitan Police are the police force under the expert of your own Independent Town of Buenos Aires.

Xavier Worthy 2024 Prizm #M-XWO Manga Instance Strike Novice RC Ohio City Chiefs

You could discover just one the newest family savings opening associated extra the a couple of years on the last coupon enrollment date and just one to incentive for each account. Here are a few very important features to look at when searching for a leading-produce checking account. When selecting, in addition to consider Bankrate’s pro reviews of preferred banks, some of which provide higher-focus deals account. The brand new Rising Financial High Produce Savings account now offers a competitive focus speed but a somewhat large minimum starting put out of $1,100. You will need to keep no less than $step 1,000 in the membership to make the fresh APY. While you are Pursue also offers multiple strong membership incentives, it’s nevertheless well worth evaluating the options.

- With a bonus Checking account (and that earns 4.62% APY), the bonus Savings account earns a very nice price from cuatro.50% APY.

- For the an associated mention, absolutely the best rates on the all of our graph recently had been the clear answer to “which hasn’t but really – but have a tendency to – join the current round away from reduces”.

- Neither Pursue nor Zelle® offers compensation to own subscribed payments you create using Zelle®, apart from a finite compensation system you to can be applied for sure imposter frauds in which you delivered currency with Zelle®.

- Innovative Brokered Certificates away from Places involve some of your own high costs on the market, nonetheless they are available with a risk.

Mothers found a great debit card due to their children, that they may use to put investing restrictions, perform discounts desires, and also begin paying. Particular student examining profile definitely restriction registration to younger someone, oftentimes those people anywhere between 17 and you can 23 or twenty four years old. It’s simple to discover students bank account, as most financial institutions supply the option online. Chase customers gain access to over 15,100000 ATMs and you will an effective mobile application to manage all financial needs.

The cash Application Credit can be used to generate distributions from ATMs and also have cash back during the checkout. CNBC Discover looks at Dollars App’s financial have and you can notices how it accumulate on the competition. Whether you are preserving to own a down payment, crisis financing or later years, that have a clear, particular deals goal can help you stay driven and you will track progress. Charges can cut to your desire income, so be sure to aren’t paying these types of. This site try covered by reCAPTCHA as well as the Privacy policy and Terms of use use.

Average money market costs

Some banks usually to switch quickly, although some could possibly get wait depending on how much they need to draw places. On the internet financial institutions, that have lower operating costs, could possibly get remain offering higher prices longer than higher antique banking institutions. Since the slash was just established, savings costs have not yet altered. Prices for the discounts membership fundamentally circulate off inside the lockstep that have policy slices. The fresh Presidential Lender Virtue Family savings is a substantial choice for savers looking to discover one another a monitoring and bank account and you will rating extremely competitive prices. Having a plus Family savings (and this earns cuatro.62% APY), the benefit Savings account produces a very nice rates away from 4.50% APY.

He advised caution to „protect well from the possibility of reducing prices both past an acceptable limit otherwise too fast”. An associate of the rate-setting Monetary Coverage Panel (MPC), Tablet told you this morning hidden rate gains are toostrong and you may highest rising cost of living criterion risked as inserted. Rates will likely must be reduce a lot more slower due so you can stubborninflation, according to Financial away from England captain economist Huw Tablet. Worries about local Us lenders’ connection with bad finance provides moved on to help you Europe, with banking institutions as the most significant fallers for the FTSE a hundred. There have been, thus far now, the biggest daily miss of your UK’s benchmark inventory directory inside 6 months.

There is a monthly services charge to the one another account which can getting waived for individuals who fulfill the requirements. To the ONB Preferred Bank account, it’s waived if you have a great $5,100000 each day balance otherwise manage a good $25,one hundred thousand joint minimal daily balance among their deposit accounts. To your ONB Everyday Checking, you can get the cost waived for those who care for $500 directly in places each month, take care of an everyday equilibrium out of $750, or take care of a mixed each day harmony out of $step one,500 within the deposit account.