A last will and testimony is a legal document that interacts an individual’s last dreams relating to their assets. It supplies details directions about what to do with their properties. It will certainly suggest whether the dead leaves them to an additional individual, a team, or wishes to donate them to charity.

A last will and testimony can additionally handle issues including dependents, the management of accounts, and monetary passions. Some states allow for non-standard or uncommon wills, such as a holographic will, while others do not.

How a Last Will and Testament Works

A will certainly and last testimony directs the disposition of your assets, such as bank equilibriums, building, or prized possessions. It will detail who is to receive home and in what quantity. It can establish guardian plans for surviving dependents. If you have an organization or financial investments, your will certainly can specify that will certainly obtain those possessions and when. A will certainly likewise enables you to direct assets to a charity (or charities), or to an institution or an organization.Read more Will Amendment At website Articles

An individual composes a will certainly while living. Its instructions are only accomplished when the private dies. A will names an executor of the will. That person is responsible for providing the estate. A probate court normally monitors the executor to ensure that the wishes specified in the will are carried out.

A will certainly and last testimony can create the foundation of an estate plan and is the crucial instrument used to make certain that the estate is cleared up in the way desired by the deceased. While there can be much more to an estate plan than just a will, the will certainly is the presiding record that a court of probate utilizes to assist the settling of an estate. Any kind of properties that have actually designated beneficiaries, such as a life insurance policy, qualified retirement, or broker agent account, are not included as probate properties and pass straight to the beneficiaries. While many people obtain assistance with their wills from a legal representative, this is not essential to make most wills legal and binding.

What Should not Be Consisted Of in a Will

- Residential or commercial property you hold collectively with somebody else

- Funeral plans: these ought to be in a different file easily obtainable after death by family members or executor

- Life insurance policies and pension: these need to have recipients assigned on the account forms so they bypass probate and flow straight to the intended receivers

Always Staying Clear Of Probate

While some wills do prevent probate, property that your will directs ought to most likely to specific beneficiaries (whether individuals or organizations) might still be tied up in court of probate for months before it can be dispersed according to your wishes.

Along with effort and time, the probate process entails lawful charges connecting to a lawyer, the administrator, and the court.

Guiding Funeral Service Setups

A will certainly shouldn’t consist of directions for funeral arrangements. That’s because, usually, it won’t be reviewed for time after death. Make certain to leave directions for funeral setups in a different paper that’s quickly accessed by the administrator or a member of the family.

Making Sure Conditional Presents

Gifts that you present with a will can not come with specific problems connected. For example, they can not be contingent on the marital relationship of a recipient, the divorce, or their faith. However, some conditions might be allowed.

Minimizing Inheritance Tax

A will doesn’t permit you to decrease or prevent taxes that will be owed on your estate.

Leaving Cash to Animals

Family pets can’t own residential property, so if your canine, feline or other animal is essential to you, you can take into consideration leaving them to a relied on person who will provide them with a caring home or locate one for them. Your will can give that individual with money to help them care for your family pet(s).

Arranging Care for Somebody With Special Demands

To offer long-lasting look after a liked one with unique needs, it’s best to establish an unique needs trust fund. The count on can direct the care and supply ongoing income, without influencing the advantages they can likewise obtain via federal government programs.

Quick Fact

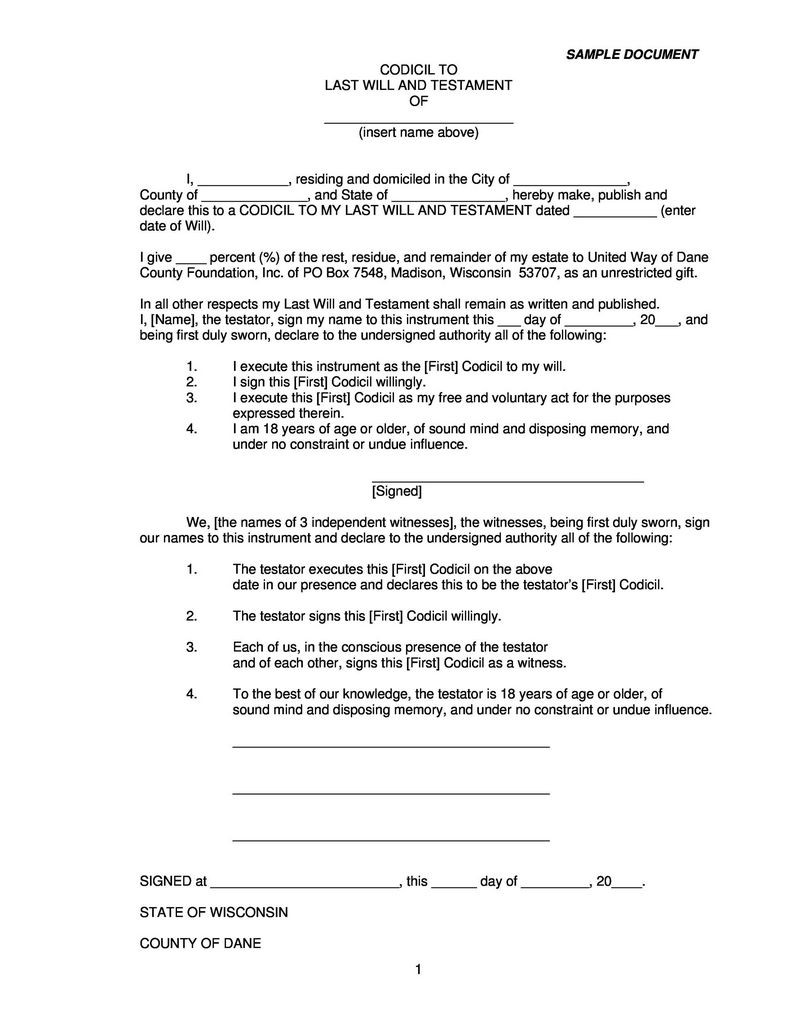

Addenda to the will, such as a power of attorney or a medical instruction, can route the court on just how to take care of matters if a person comes to be literally or emotionally incapacitated.

Last Will and Testimony Requirements

Be of Sound Mind

A legitimate will needs that you more than the age of bulk, understand what property you have, and what it indicates to leave residential property to others after your death.

Recognize Assets and Beneficiaries

A will needs you to identify the properties and residential property that are to be bestowed in addition to the identifications of the designated receivers (known as named recipients).

Designate an Executor

A will certainly must designate an executor to accomplish the will certainly’s guidelines according to the dreams of the deceased.

Witnesses to Your Signature

For a will to be thought about legitimate, it has to be signed. Several jurisdictions likewise need that the finalizing of a will certainly be experienced by at least 2 unassociated individuals, age 18 or over.2 Inspect your state laws for this details.

Sorts of Wills

The four major kinds of wills are the simple will, the joint will, the testamentary trust fund will, and the living will.

Easy Will

Make use of a simple will to detail your properties and the beneficiaries that must obtain them. You can also designate the executor and a guardian for any type of minor children. A simple will certainly is one that can be done quickly on the internet utilizing among various layouts. Make sure to obtain any lawful recommendations you feel you require.

Joint Will

A joint will certainly is one file that entails two people, normally spouses. When one dies, the will is executed in favor of the various other partner, as specified in the will. The provisions can not be transformed by the enduring partner, which can be a problem if that spouse’s circumstances alter.

Joint wills aren’t as usual as they when were due to this inflexibility.

Testamentary Depend On Will

This will certainly consists of one or more testamentary trust funds that take effect after your death and the probate process (unlike, for instance, a living depend on which takes effect during your lifetime). It is made use of in circumstances where recipients, such as small kids and/or those with unique needs, need details care over a long period of time. The trust distributes all or a part of your assets after you pass.

Living Will certainly

This kind of will just worries your healthcare and decision-making should you come to be incapacitated. It is a legal document that provides guidelines for your treatment and, among other things, the discontinuation of clinical support.3 It does not take care of a distribution of your property to beneficiaries or various other such final desires.

You do not require an attorney to create a legitimately identified and approved living will. In fact, medical centers or your state government can provide living will forms to you. Each state has certain legal needs for valid living wills. Make certain that you comprehend them prior to developing one.

Wills vs. Depends on

Wills and counts on are both crucial estate-planning devices, however they differ in essential ways. Counts on are legal entities developed by people referred to as grantors (likewise referred to as trustors or settlors) that are designated properties and advise in the personality of those assets. A trustee is assigned by the count on record to manage and distribute those possessions to recipients, according to the dreams of the grantor as detailed in the document.

A trust fund can be developed for a selection of functions, and there are several types of trusts. Overall, there are 2 classifications: living and testamentary. A will certainly can be utilized to develop a testamentary depend on. You can also develop a revocable living trust for the main function of staying clear of court of probate.

Exactly how to Develop a Will

Right here are the actions to require to develop a will.

- Consider whether you’ll collaborate with an estate lawyer in a conventional manner to develop your will or create it using an on the internet solution. Establish contact to obtain the process moving.

- Decide on the properties that you intend to include in your will.

- Name your recipients and the home each ought to obtain.

- Designate an administrator. Make certain to obtain their approval initially.

- If you have small kids, assign a guardian for them. Once again, acquire their arrangement in advance.

- Sign your will. Two witnesses to your signing are called for in the majority of states and some may need even more (inspect your state’s laws on this and whether your will need to be notarized).

- Store your will securely. Think about a secure deposit box at your local financial institution and make certain your administrator is lawfully licensed by the financial institution to gain access to it.

- Occasionally examine your will and make updates to it as needed.

Creating a will can often be an easy and inexpensive procedure where you submit a type online without the help of an estate preparation lawyer. Online will makers allow you to draft, print, and sign your last will and testament using an online or downloaded and install document creator.

This is a more affordable method to establish will and count on files compared to visit an attorney or in-person legal solution. Most online will certainly makers stroll users via a collection of questions to populate the called for fields.

Crucial

There are important differences in between a will and a trust. Unlike a will, which can often be written on one’s very own or using an online will manufacturer, depends on typically are created with the help of a certified lawyer, yet it isn’t lawfully needed.

Repercussions of Not Having a Will

When an individual dies without a valid will, it is stated that they have died intestate. This indicates that the state becomes the administrator of the estate. It determines how to distribute the residential or commercial property and who receives repayment first, without consideration for a household’s scenarios. The court can even develop guardianship arrangements based on its resolution of the best passions of the kids.

The probate laws in many states separate residential or commercial property among the surviving partner and youngsters of the deceased. For instance, a resident of Arizona, New Mexico, California, Texas, Idaho, Nevada, Washington, Louisiana, or Wisconsin who dies without a legitimate will has to have their estate split according to the neighborhood building regulations of the state. Neighborhood home legislations recognize both partners as joint property owners.

Basically, the circulation hierarchy starts with the surviving spouse, who almost usually receives at least half the decedent’s estate. They may get the entire estate if the decedent leaves no living kids or grandchildren. If the decedent is unmarried or widowed at the time of fatality, possessions will be divided among any kind of surviving kids before any other family member. If no next of kin can be located, the possessions in the estate will end up being the residential or commercial property of the state.

All-time Low Line

A last will and testament is a basic lawful document in a person’s estate plan. It outlines a person’s last desires pertaining to their assets. It gives particular directions about exactly how to disperse their ownerships. There are certain things a will certainly can not complete for an individual, such as reduce estate taxes or aid a family totally prevent probate court.

Wills can be simple to create yet have demands that need to be dealt with in order for them to be thought about legitimate. Please examine your state legislations regarding a last will and testament to ensure you take the right actions when producing your own.